By: Brittney Goodrich

What Is It And How Can I Enroll?

The Apiculture Pilot Insurance Program (API) is insurance offered through the United States Department of Agriculture (USDA) Risk Management Agency (RMA) meant to insure beekeepers against lower than average rainfall which could negatively affect honey production. API was at first piloted in a few states, and expanded to include all 48 contiguous states in July of 2017. API participation rates throughout the country are relatively low, and many beekeepers I’ve talked to are unaware of the program or are skeptical of it. This article provides an overview of the API program and references if you want to learn more about it.

API is a type of index insurance, meaning policies are not based on actual production or loss, rather payments are triggered by low precipitation relative to a chosen coverage level. Payments and coverage are based on a grid system, where grids cover an area of 0.25 degrees latitude by 0.25 degrees longitude (roughly 17 miles x 17 miles at the equator). An API policy is based on the specific grid (or grids) in which colonies are located. Rainfall index values are calculated by a weighted average of nearby National Oceanic and Atmospheric Administration (NOAA) weather stations, and are reported in relation to historical average rainfall in that grid.

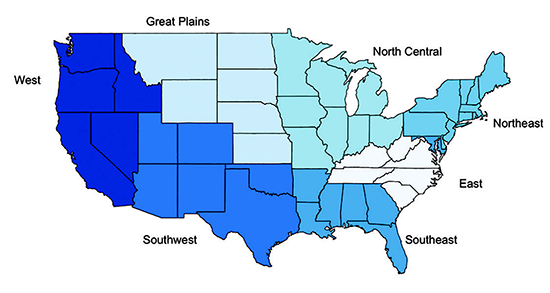

So, what do current participation rates look like in the API program? Table 1 details the regional participation in API in 2018, where the honey producing regions are defined in Figure 1. In 2018, 811,249 colonies in the U.S. are insured with this program. Using the number of colonies in the U.S. on July 1, 2016, this amounts to just over 25% of total U.S. colonies insured. The western region of the U.S. has by far the most colonies enrolled in API, with a majority of those colonies (72%) being insured in California.

Table 1. 2018 API Participation by Region (Source: USDA RMA Summary of Business Reports and Data, 2018)

Before getting into the components of an API policy, I think it’s helpful to outline some common insurance jargon.

Indemnity: The amount of money you collect when the rainfall index falls below your chosen coverage level.

Premium: The amount of money you must pay for your API insurance policy.

Subsidy: The portion of your premium that the Federal Crop Insurance Corporation will pay.

To participate in API, producers must make a number of decisions.

- Insured Colonies: Beekeepers must choose the number of colonies that will be insured. Not all of a beekeeper’s colonies need to be insured. There is also no minimum number of colonies necessary, so small beekeeping operations may participate. Knowing that most commercial beekeepers are migratory, it is important to note that you cannot insure the same colonies across multiple grids.

- Two-month Index Interval and Percentages of Value: The crux of the API insurance lies in the choices of coverage level and two-month intervals. Producers must choose two-month intervals in which they want to insure against low rainfall. Two-month intervals run from January-February to November-December, and a participant cannot choose overlapping intervals, i.e., March-April and April-May. The participant must also place a percentage of value into each chosen interval to represent the portion of total insured value which is dependent on rainfall during that two-month interval. A beekeeper’s placement of percentages of value would likely reflect the ranking of which month intervals matter most for honey production.

- Coverage Level: The coverage level chosen determines the percentage of average historical rainfall at which insurance coverage kicks in. The possible coverage levels are 70, 75, 80, 85, or 90%. For example, if a participant chooses 90% coverage and January-February and March-April intervals, an indemnity would be paid if the rainfall index in either January-February or March-April falls below 90% of the historical average. –Subsidy levels differ depending on the coverage level chosen. Subsidy levels range from 51-59%, with the lowest coverage level (70%) receiving the highest subsidy level (59%).

- Productivity Factor: Beekeepers can adjust the value insured by adjusting the productivity factor. USDA RMA estimates county base values using a five-year rolling average of state honey yields and the national average honey price. Participants can update the county base values to better reflect the value in their own operation by adjusting the productivity factor within the range 60-150%.

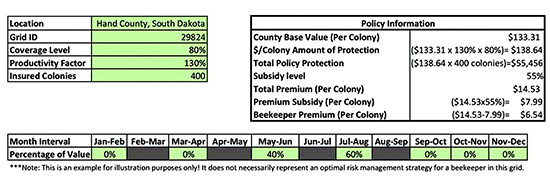

Table 2 shows an example of a 2018 API policy option for a South Dakota honey producer who believes the months of June and July are most influential for honey production. In the example, the beekeeper would receive an indemnity if the rainfall index in either May-June or July-August falls below the coverage level of 80%. The county base value for this policy is $133.31. The producer believes this value is too low so he chooses a productivity factor of 130% to increase his insured dollar value.

There are trade-offs with choosing the insured dollar value and coverage levels. The higher the coverage level, the higher cost of the insurance but the higher chance of a collected indemnity. Similarly, the higher the insured amount, the higher the cost of the insurance but also the higher the indemnity amount paid out with low rainfall.

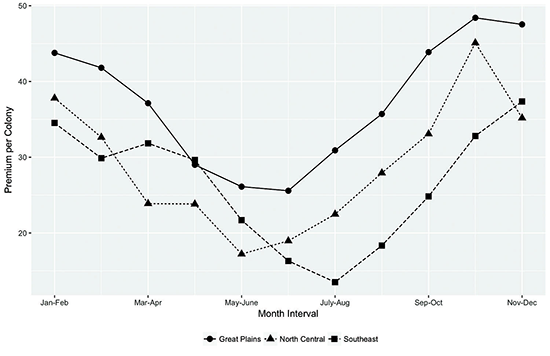

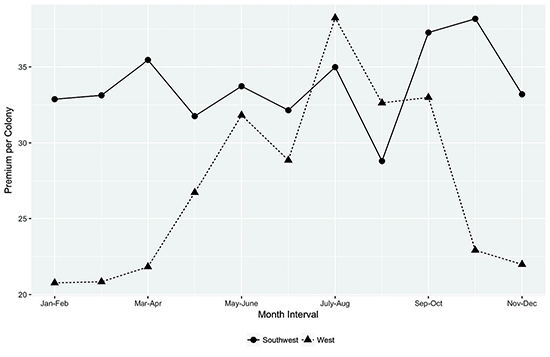

In addition to varying based on coverage level and insured value, API insurance premiums vary depending on the month intervals chosen and geographical location. Figures 2 and 3 display 2018 average premiums per colony by the two-month interval chosen in each region (East and Northeast regions were omitted due to the low number of policies purchased in those regions). The Great Plains, North Central and Southeast regions have similar seasonal trends in rainfall, so in these areas, premiums are significantly higher in the winter than during the spring and summer. The West and Southwest regions differ significantly from the other regions in rainfall patterns, so premiums look much more sporadic throughout the year. In fact, the West region sees premium patterns nearly opposite of those found in figure 2, with high premiums during the summer and low premiums during the winter months.

Figure 2. 2018 Regional Average Per-Colony Premium for Colonies Enrolled in API by Choice of Two-month Interval, Great Plains, North Central, and Southeast (Source: USDA RMA Summary of Business Reports and Data, 2018)

Figure 3. 2018 Regional Average Per-Colony Premium for Colonies Enrolled in API by Choice of Two-month Interval, Southwest and West (Source: USDA RMA Summary of Business Reports and Data, 2018)

Figure 4 depicts average per-colony premiums, subsidies, and indemnities for each region in 2017. On average in 2017, participating beekeepers in all regions received more in indemnity than they paid out in premiums (after accounting for the subsidy). This payout from low precipitation is meant to offset decreases in revenue and increases in costs due to low honey production. In a high rainfall year, average indemnities may be less than premiums paid in by beekeepers. It is presumed that higher than average rainfall will result in higher than average honey production, so beekeeping revenues would be higher and/or costs of feeding lower.

Figure 4. Regional Average API Premium, Subsidy, and Indemnity Rates, $/Colony (Soutce: USDA RMA Summary of Business Reports and Data, 2017)

USDA RMA provides a useful online decision tool (see reference below) that producers can access to find their grid, explore policy options and costs, and plot out historical rainfall indices and policy outcomes. API insurance can be purchased by any authorized crop insurance agent (see link below for agent locator). The enrollment deadline for 2019 API is November 15, 2018, and the premium payment deadline is September 1, 2019.

API has potential to be a useful risk management tool for beekeepers, especially at the current subsidy rates. API is not set up to insure against all factors influencing honey production, so it should not be used as the only tool for managing risk. I encourage you to look into this product for your operation. See the following resources for more information.

General API Policy Info: https://www.rma.usda.gov/policies/ri-vi/apiculture.html

API Grid Locator: http://maps.agforceusa.com/api/ri/

API Decision tool: http://api.agforceusa.com/ri

Crop Insurance Agent Locator: https://prodwebnlb.rma.usda.gov/apps/AgentLocator/#/

Brittney Goodrich is Assistant Professor, Agricultural Economics and Rural Sociology, Auburn University.